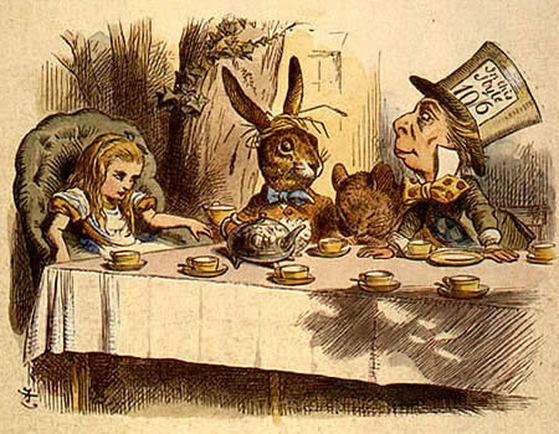

The Mad Hatter and the Tea Party

“The piece below was written in response to a blog post by one of the world’s most highly acclaimed New Testament Scholars. In it, he indirectly suggested that the members of the Tea Party should be good sports and just pay their taxes."

A simple way of understanding the problem is by looking at the economic health of our government, juxtaposed against the economic condition of the average American. We have accumulated unprecedented amounts of debt, both as individuals and as a nation. Can Americans continue to take on new debts at a time when our personal income is falling and the job market is uncertain? That same question is equally relevant for our leaders in Washington. Can the government take on massive new debts—fighting what appears to be an endless war—while substantially increasing the size of government with new entitlements at a time when tax revenues (the government’s primary source of income) are falling?

The problem is circular in nature. The wellbeing of the average American is inseparable from the fortunes of our government. The Tea Parties recognize this and so should the rest of the nation. We can't spend our way to prosperity, any more than a person who is unemployed or under-employed can use credit cards to spend their way to prosperity. Eventually the bill will come due and the only thing you will have is more debt and no way to pay for it. We will be forced to either substantially raise taxes across the board, which will only harm a struggling economy, or print more money and devalue the dollar further, creating inflation. Either way, Americans will lose.

On the other hand, what should we cut back on? Spending for the poor, widow and orphan—or military expansion and endless wars in the Middle East? There is little doubt that abuse in the area of entitlements is rampant, but the same is true for military spending and the various forms of corporate welfare as well. I believe that you will find greater philosophical diversity among the Tea Party than the media portrays.

Politicians are busy attempting to maintain the status quo, namely their own position and power, with almost no real will to make the hard choices. Both Herman Cain and Ron Paul are at least attempting to move beyond politics as usual. Ron Paul, however, is unelectable; such is the nature of telling people what they don't want to hear. Herman Cain is a more likely and likable candidate, with both an impressive record in his personal life and in the private sector, albeit, with very little real political experience.

His 9-9-9 plan is simple and workable, with a few strategic changes. The biggest obstacle will be its immediate impact on the poor, for whom a 9% increase in the cost of living could be devastating. It would likely be portrayed as a substantial tax cut for the rich and a tax increase for the poor—which it would be. The only way that this can work is if you exempt food and, perhaps, a few other basic necessities. It would then be less harmful to the most vulnerable members of society and would, likewise, help to free up a lot of frozen capital for investing, creating new jobs, simplifying a less regressive tax code, and helping to create an economic boom. But, unless Americans are willing to substantially cut spending and begin to eliminate the massive waste and fraud in government, nothing much will change. The chickens will eventually come home to roost and the suffering that we see now will only be a prelude to something far, far worse.

Our military problems are likewise chained to a corrupted form of crony capitalism that in no way mirrors the free market principles that are the basis of American prosperity. The situation in the Middle East is a prime example. The only commodity of real value in that region of the world is oil (Israel is a different debate for another time, although there are clear linkages). We could fairly easily replace our need for Middle Eastern oil by importing more from Central America and by drilling for it domestically. If we really wanted to solve this particular problem we could move to natural gas, which we have in abundance. This would create new jobs and give us much needed new tax revenue, which, in part, answers the question at hand.

Natural gas burns 90% clean and costs about half of what a gallon of gasoline costs, making it beneficial to the environment and a boon to the economy, while giving average Americans more money to save and spend. If we relied upon it, the OPEC nations would either be forced to adapt or self-destruct under the pressure produced by tremendous financial losses—including lowering the cost of oil per barrel as the result of competition from domestic producers of both oil and natural gas. That alone would create an immediate economic benefit. The radical element in the OPEC nations that is now tolerated, and even modestly supported, would, most likely, be cut off.

Competition forces not only innovation, but better relationships. China is a good example. They are willing to buy our debt and devalue their own currency in order to access American markets and consumers—a necessary key to their own prosperity, as well as ours. It is clear, or at least it should be, that taxes aren’t the real issue. It is very easy demagoguery, however, articulated in terms of class warfare instead of intelligent business practices.

We are living out a very old story, one of colonial occupation and militarism on the one hand, and the question of “What is the appropriate role of the law?” on the other. Jesus, in his time, spoke to both. Taxation was, and is, a major issue because cumbersome political and legal systems are expensive and so are armies. Can a man be moral because he keeps the Law? Or must a man be changed from within—and in doing so, live in liberty.

Mark Magula

A simple way of understanding the problem is by looking at the economic health of our government, juxtaposed against the economic condition of the average American. We have accumulated unprecedented amounts of debt, both as individuals and as a nation. Can Americans continue to take on new debts at a time when our personal income is falling and the job market is uncertain? That same question is equally relevant for our leaders in Washington. Can the government take on massive new debts—fighting what appears to be an endless war—while substantially increasing the size of government with new entitlements at a time when tax revenues (the government’s primary source of income) are falling?

The problem is circular in nature. The wellbeing of the average American is inseparable from the fortunes of our government. The Tea Parties recognize this and so should the rest of the nation. We can't spend our way to prosperity, any more than a person who is unemployed or under-employed can use credit cards to spend their way to prosperity. Eventually the bill will come due and the only thing you will have is more debt and no way to pay for it. We will be forced to either substantially raise taxes across the board, which will only harm a struggling economy, or print more money and devalue the dollar further, creating inflation. Either way, Americans will lose.

On the other hand, what should we cut back on? Spending for the poor, widow and orphan—or military expansion and endless wars in the Middle East? There is little doubt that abuse in the area of entitlements is rampant, but the same is true for military spending and the various forms of corporate welfare as well. I believe that you will find greater philosophical diversity among the Tea Party than the media portrays.

Politicians are busy attempting to maintain the status quo, namely their own position and power, with almost no real will to make the hard choices. Both Herman Cain and Ron Paul are at least attempting to move beyond politics as usual. Ron Paul, however, is unelectable; such is the nature of telling people what they don't want to hear. Herman Cain is a more likely and likable candidate, with both an impressive record in his personal life and in the private sector, albeit, with very little real political experience.

His 9-9-9 plan is simple and workable, with a few strategic changes. The biggest obstacle will be its immediate impact on the poor, for whom a 9% increase in the cost of living could be devastating. It would likely be portrayed as a substantial tax cut for the rich and a tax increase for the poor—which it would be. The only way that this can work is if you exempt food and, perhaps, a few other basic necessities. It would then be less harmful to the most vulnerable members of society and would, likewise, help to free up a lot of frozen capital for investing, creating new jobs, simplifying a less regressive tax code, and helping to create an economic boom. But, unless Americans are willing to substantially cut spending and begin to eliminate the massive waste and fraud in government, nothing much will change. The chickens will eventually come home to roost and the suffering that we see now will only be a prelude to something far, far worse.

Our military problems are likewise chained to a corrupted form of crony capitalism that in no way mirrors the free market principles that are the basis of American prosperity. The situation in the Middle East is a prime example. The only commodity of real value in that region of the world is oil (Israel is a different debate for another time, although there are clear linkages). We could fairly easily replace our need for Middle Eastern oil by importing more from Central America and by drilling for it domestically. If we really wanted to solve this particular problem we could move to natural gas, which we have in abundance. This would create new jobs and give us much needed new tax revenue, which, in part, answers the question at hand.

Natural gas burns 90% clean and costs about half of what a gallon of gasoline costs, making it beneficial to the environment and a boon to the economy, while giving average Americans more money to save and spend. If we relied upon it, the OPEC nations would either be forced to adapt or self-destruct under the pressure produced by tremendous financial losses—including lowering the cost of oil per barrel as the result of competition from domestic producers of both oil and natural gas. That alone would create an immediate economic benefit. The radical element in the OPEC nations that is now tolerated, and even modestly supported, would, most likely, be cut off.

Competition forces not only innovation, but better relationships. China is a good example. They are willing to buy our debt and devalue their own currency in order to access American markets and consumers—a necessary key to their own prosperity, as well as ours. It is clear, or at least it should be, that taxes aren’t the real issue. It is very easy demagoguery, however, articulated in terms of class warfare instead of intelligent business practices.

We are living out a very old story, one of colonial occupation and militarism on the one hand, and the question of “What is the appropriate role of the law?” on the other. Jesus, in his time, spoke to both. Taxation was, and is, a major issue because cumbersome political and legal systems are expensive and so are armies. Can a man be moral because he keeps the Law? Or must a man be changed from within—and in doing so, live in liberty.

Mark Magula